Turn College Planning Into a Competitive Advantage.

Education Advisor gives you ROI-driven tools

to help clients make smarter education decisions—protecting assets, preserving long-term plans, and strengthening your role as their trusted advisor across generations.

Derail

Financial

Plans

You work hard to help your clients build wealth. But one wrong education

decision can put years of careful

planning at risk.

Families take on debt that undermines retirement or investment goals

Poor-fit majors lead to extended college timelines and lost earnings

Clients chase prestige over real career ROI

Education planning often happens outside your process, reducing your influence

Advisors who don’t address these risks lose trust—or lose clients

Every college decision is a financial decision.

But most families are navigating it alone.

Bring Education

Strategy Into Your

Financial Process

Education Advisor helps you proactively guide clients through

one of the most expensive—and emotionally charged—

financial choices they’ll ever make.

Compare career paths based on earnings, demand, and ROI Evaluate college, trade, certification, and apprenticeship options side-by-side

Integrate education planning into broader retirement and estate strategies

Use client-facing reports to drive high-trust conversations Promote scholarships and funding options to reduce out-of-pocket costs

Position yourself as a holistic, life-stage advisor—not just an investment manager

Seamlessly complement platforms like eMoney or Right Capital

Build early relationships with the next generation of clients—their children—by guiding them through one of their first major financial decisions

You stay in control of the conversation. Your clients stay protected—and deeply loyal.

Be the Advisor They

Trust for Life’s Biggest

Decisions.

The best advisors don’t just manage money.

They guide families through life-shaping decisions—building trust across multiple generations. By helping parents navigate one of the largest financial decisions they’ll ever make, you also earn the trust of their children turning today’s planning into tomorrow’s client pipeline.

“Education Advisor allows me to have conversations most advisors avoid. I’m not just protecting assets—I’m protecting futures. My clients see that. And their kids do too.”

— DAVID P., CFP®, MULTI-GENERATIONAL WEALTH ADVISOR

Let’s Build Deeper, Longer-Lasting Client Relationships.

See how Education Advisor can help you expand your value, protect client wealth, and strengthen trust across every stage of your clients’ lives—now and into the next generation.

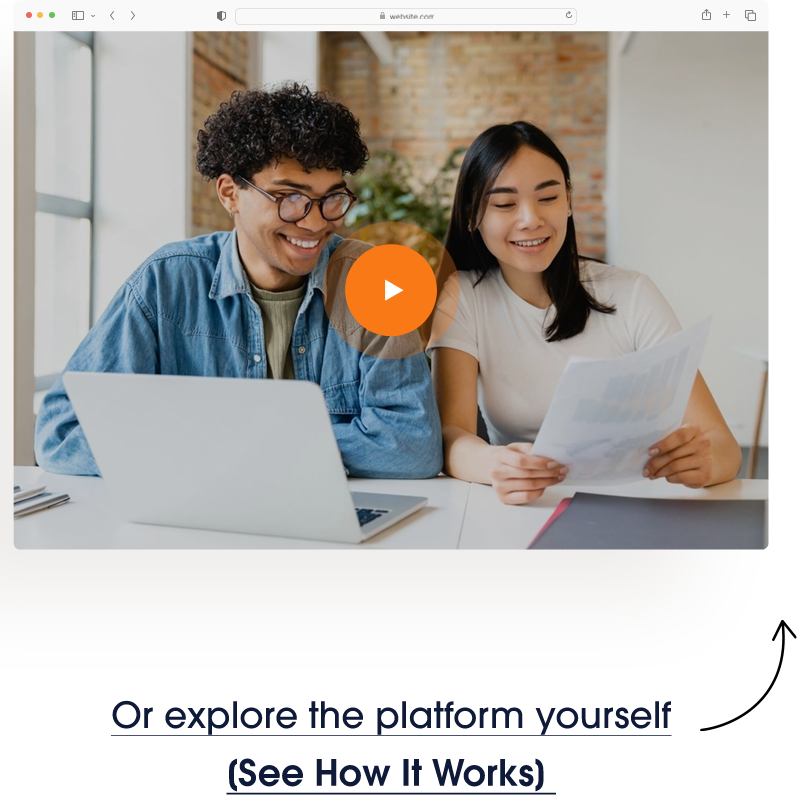

Or explore the platform yourself ![]() See How It Works.

See How It Works.