Our Educational Rating Calculator Explained

The Basics of Rating Calculation

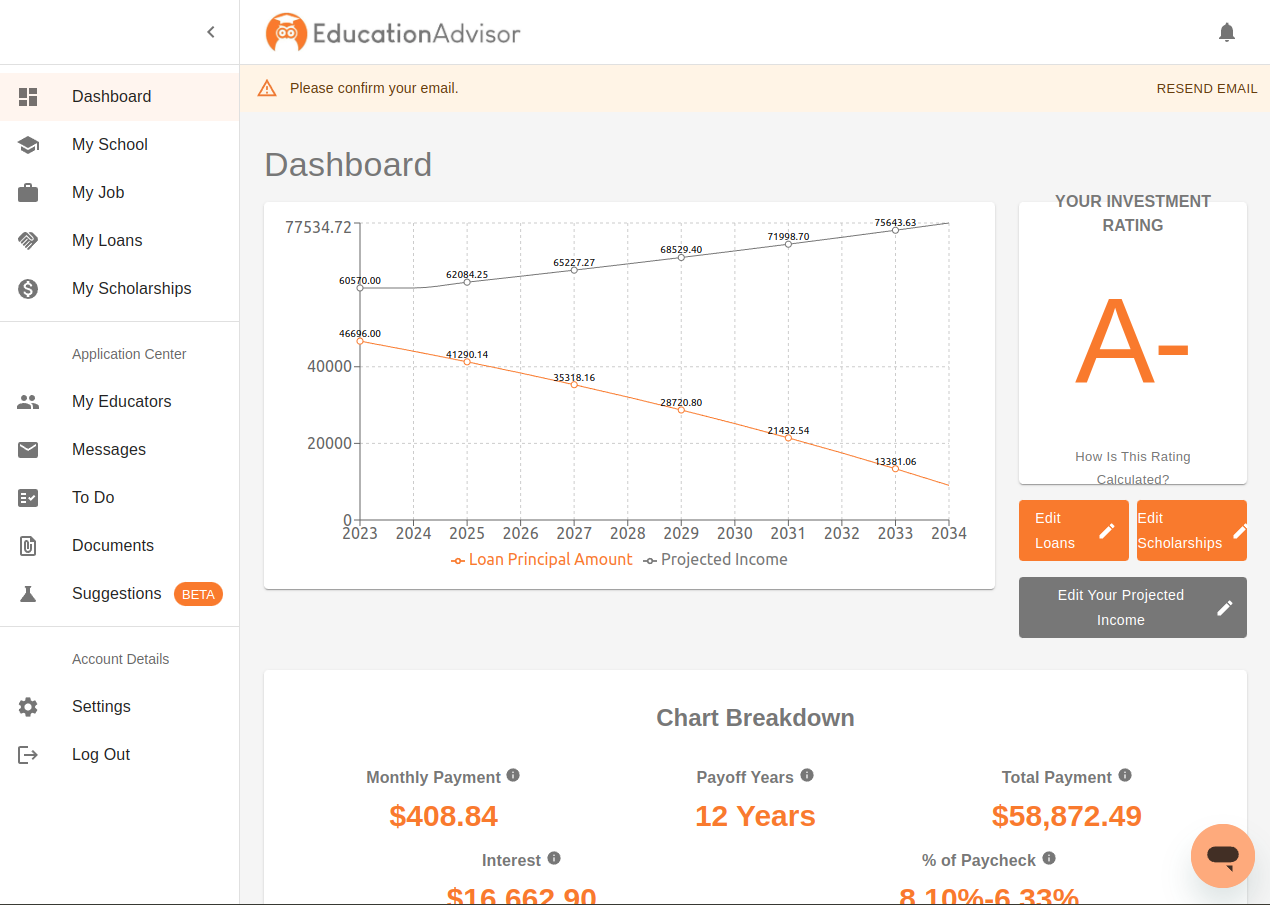

- Debt to Income Ratio: The foundation of your education rating is built upon your Debt to Income (DTI) ratio. This ratio is determined by comparing the projected income you’re expected to earn in the future against the amount of debt you’ll incur during your educational journey.

- Percentage-Based Calculation: The rating is calculated using a percentage-based formula. Initially, when you sign up, it’s based on a general direct subsidy model. This model serves as a baseline for understanding how your financial situation could unfold.

Exploring the Rating Scenario

- Fixed Repayment Plan: The rating scenario provided assumes a 12-year fixed repayment plan, primarily designed for a four-year tuition. This scenario offers insights into the financial implications of not making any initial payments towards college.

- Customization Options: You have the flexibility to tailor the scenario based on your specific financial circumstances. Here’s how you can do it:

- Access the loan section to input your financial details.

- Adjust parameters like loan balance, interest rate, loan term, and repayment plan.

- Observe the changes in your monthly payment and the overall rating.

Impact of Adding Loans on DTI

- Understanding DTI: Your Debt to Income (DTI) ratio is a crucial metric that determines your financial health. It measures how much of your income will go towards repaying debt. Adding loans to your education expenses can significantly affect this ratio.

- Customization Example: Let’s consider an example: Suppose you have a loan balance of $20,000 with a 4% interest rate and a 12-year loan term. Initially, your DTI ratio is calculated based on this loan scenario.

- Impact on DTI: By adding loans, your monthly payments will increase, impacting your DTI ratio. A higher DTI ratio indicates that a larger portion of your income will go towards repaying debt, potentially affecting your overall financial stability.

Maximizing Scholarships

- Adding Scholarships: Scholarships can significantly impact your education rating. To include scholarships in your calculation:

- Input the scholarship amount and specify whether it’s recurring and for how many years.

- This addition will affect your projected income and overall rating.

Exploring Career Options

- Suggestions and Career Comparison: The application also offers valuable insights into potential career choices and their financial implications:

- Explore the “Suggestions” tab to discover alternative occupations.

- Compare different schools and their financial outcomes.

- Make informed decisions based on your career aspirations and financial goals.

your education rating is a powerful tool that assists you in assessing the financial aspects of your educational journey. It’s primarily based on the debt to income ratio and can be customized to reflect your unique circumstances, including scholarships, career choices, and the impact of loans on your DTI.

Understanding how loans affect your DTI ratio is crucial in managing your financial health during and after your education. Feel free to reach out to us with any questions or for further assistance. We are here to help you make informed decisions about your education and financial future.